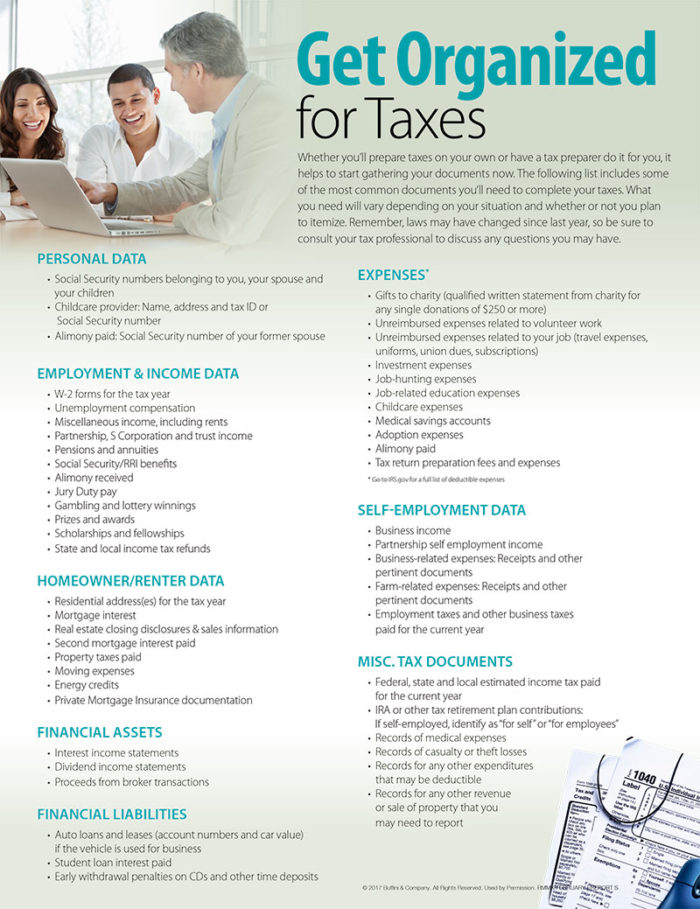

Whether you’ll prepare taxes on your own or have a tax preparer do it for you, it helps to start gathering your documents now. The following list includes some of the most common documents you’ll need to complete your taxes. What you need will vary depending on your situation and whether or not you plan to itemize. Remember, laws may have changed since last year, so be sure to consult your tax professional to discuss any questions you may have.

PERSONAL DATA

• Social Security numbers belonging to you, your spouse and your children

• Childcare provider: Name, address and tax ID or Social Security number

• Alimony paid: Social Security number of your former spouse

EMPLOYMENT & INCOME DATA

• W-2 forms for the tax year

• Unemployment compensation

• Miscellaneous income, including rents

• Partnership, S Corporation and trust income

• Pensions and annuities

• Social Security/RRI benefits

• Alimony received

• Jury Duty pay

• Gambling and lottery winnings

• Prizes and awards

• Scholarships and fellowships

• State and local income tax refunds

HOMEOWNER/RENTER DATA

• Residential address(es) for the tax year

• Mortgage interest

• Real estate closing disclosures & sales information

• Second mortgage interest paid

• Property taxes paid

• Moving expenses

• Energy credits

• Private Mortgage Insurance documentation

FINANCIAL ASSETS

• Interest income statements

• Dividend income statements

• Proceeds from broker transactions

FINANCIAL LIABILITIES

• Auto loans and leases (account numbers and car value) if the vehicle is used for business

• Student loan interest paid

• Early withdrawal penalties on CDs and other time deposits

Home Selling Resources

| Complete Guide to Home Selling | Get a Free Consultation on Selling Your Home |

| 10 Tips to Selling Your Home | How to Prepare Your Home for Sale |

| Find Out What Your Home is Worth |

Home Buying Resources

| Search Homes For Sale Now | View Open House List |

| Home Buying Process – A Complete Guide | 7 Tips to Home Buyer Success |

| Free Home Buyer Consultation | Why You Need A Buyers Agent |