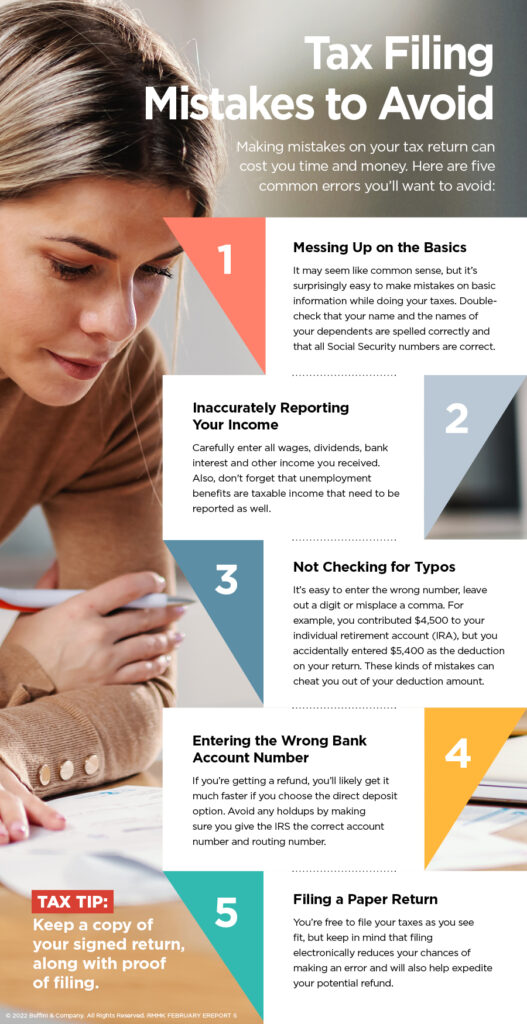

Making mistakes on your tax return can cost you time and money. Here are five common errors you’ll want to avoid:

1. Messing Up on the Basics

It may seem like common sense, but it’s surprisingly easy to make mistakes on basic information while doing your taxes. Doublecheck that your name and the names of your dependents are spelled correctly and that all Social Security numbers are correct.

2. Inaccurately Reporting Your Income

Carefully enter all wages, dividends, bank interest and other income you received. Also, don’t forget that unemployment benefits are taxable income that need to be reported as well.

3. Not Checking for Typos

It’s easy to enter the wrong number, leave out a digit or misplace a comma. For example, you contributed $4,500 to your individual retirement account (IRA), but you accidentally entered $5,400 as the deduction

on your return. These kinds of mistakes can cheat you out of your deduction amount.

4. Entering the Wrong Bank Account Number

If you’re getting a refund, you’ll likely get it much faster if you choose the direct deposit option. Avoid any holdups by making sure you give the IRS the correct account number and routing number.

5. Filing a Paper Return

You’re free to file your taxes as you see fit, but keep in mind that filing electronically reduces your chances of making an error and will also help expedite your potential refund.

Home Selling Resources

| Complete Guide to Home Selling | Get a Free Consultation on Selling Your Home |

| 10 Tips to Selling Your Home | How to Prepare Your Home for Sale |

| Find Out What Your Home is Worth |

Home Buying Resources

| Search Homes For Sale Now | View Open House List |

| Home Buying Process – A Complete Guide | 7 Tips to Home Buyer Success |

| Free Home Buyer Consultation | Why You Need A Buyers Agent |