Once your credit is in great shape, make sure it stays that way with these tips.

Maintain low balances on your credit cards and revolving lines of credit.

Once you’ve paid them down, keep the balances low by using them only for emergencies. If the balance is currently high on one or more cards or credit lines, begin paying them down, starting with the card or credit line with the highest interest rate first.

Set up automatic bill pay.

Many creditors and utility companies make it easy to pay your bills on time by sending reminders before the payment is due. Additionally, setting up an automatic payment will ensure the bill is paid on time.

Keep rate shopping within a 30-day window of time.

If you’re thinking of taking out a loan to buy a car or a home, limit your rate search to a small timeframe so the inquiries will likely be treated as a single one. The more inquiries into your credit, the more likely they’ll count against your score.

Reconsider closing accounts.

Even if you don’t use a line of credit anymore, it may not be a good idea to close it. Closing several accounts at once may raise red flags and impact your credit. Instead, leave the balance at zero and try not to use it.

Be responsible.

It takes time to build great credit; it also takes time to rebuild your credit once it’s damaged. Once you’ve earned a great credit score, continue good financial habits to maintain it.

The difference between “Good” and “Excellent” credit

What is a “Good” credit score?

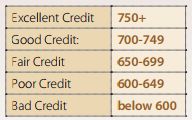

Although lenders often decide what they consider acceptable credit, the credit tiers generally break down as follows:

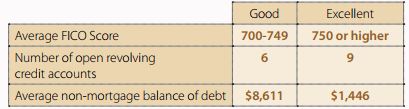

What separates those with “Good” credit from those with “Excellent” credit?

Although people with excellent credit have more open revolving credit accounts, they don’t actively use them and the debt they do carry makes up a lower percentage of their overall available credit.

40% of Americans fit FICO’s High Achiever profile with a score of 750 or higher; of that total, more than 25% have a score above 800.

Home Selling Resources

| Complete Guide to Home Selling | Get a Free Consultation on Selling Your Home |

| 10 Tips to Selling Your Home | How to Prepare Your Home for Sale |

| Find Out What Your Home is Worth |

Home Buying Resources

| Search Homes For Sale Now | View Open House List |

| Home Buying Process – A Complete Guide | 7 Tips to Home Buyer Success |

| Free Home Buyer Consultation | Why You Need A Buyers Agent |